Introduction: Why FreshBooks is More Than Just Invoicing

Managing business finances can be a nightmare if you’re juggling multiple tools for invoicing, expenses, time tracking, and reporting. That’s where FreshBooks comes in—a cloud accounting software tailored for freelancers, solopreneurs, and small businesses who want to spend less time on paperwork and more time growing their business. But is FreshBooks worth it in 2025? Let’s dive in.

Key Features of FreshBooks

FreshBooks offers a robust set of tools that streamline essential financial tasks. Here’s what stands out:

- Smart Invoicing: Create professional, customizable invoices in minutes. Set up recurring invoices, auto-payment reminders, and even accept credit card and ACH payments right from the invoice.

- Time Tracking: Log billable hours directly into your projects or invoices. This is a major win for consultants and service-based businesses.

- Expense Tracking: Snap photos of receipts and categorize expenses automatically. You can also link bank accounts for real-time tracking.

- Double-Entry Accounting: FreshBooks now includes balance sheets, journal entries, and bank reconciliation—essential for accountants and bookkeepers.

- Team Collaboration: Add team members, assign roles, and track productivity across multiple projects.

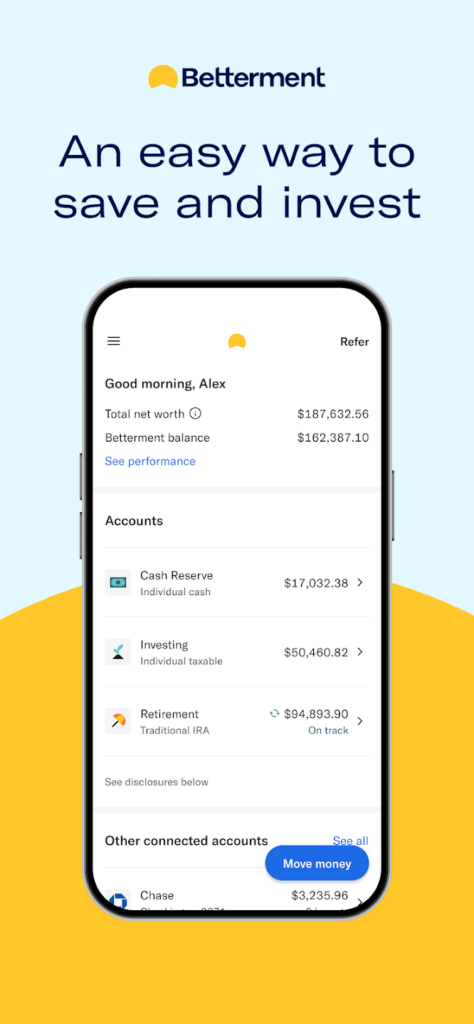

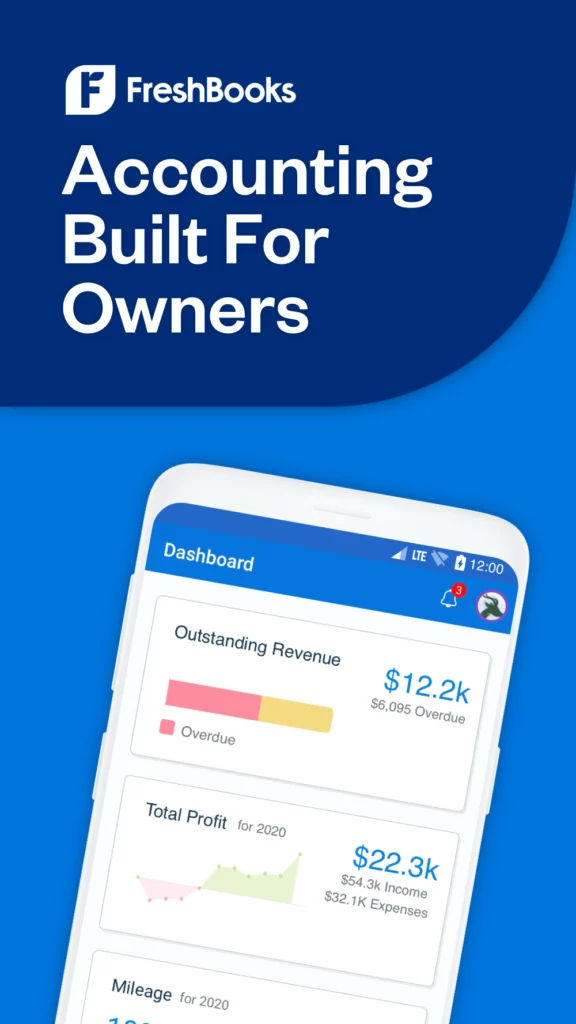

- Mobile App: The iOS and Android apps are fully featured, letting you manage invoices, expenses, and time tracking on the go.

User Interface & Experience

FreshBooks is one of the most user-friendly accounting apps on the market. The dashboard is clean, modern, and easy to navigate—even for users without a financial background. Whether you’re creating an invoice or reviewing your profit and loss report, the entire experience feels intuitive and smooth.

Performance and Reliability

FreshBooks is cloud-based and performs reliably across devices. It loads quickly, syncs data in real-time, and integrates well with third-party apps like Gusto, Stripe, Shopify, and Zapier. During testing, there were no lags or errors, and customer support was responsive via both chat and email.

What Makes FreshBooks Stand Out?

While there are plenty of accounting tools out there—like QuickBooks, Xero, and Wave—FreshBooks sets itself apart with its blend of simplicity and professional-grade features. It’s especially ideal for solo entrepreneurs and small teams that don’t need the complexity of enterprise-level platforms but still want comprehensive functionality.

Another major plus is FreshBooks’ client portal, where customers can view invoices, make payments, and leave feedback—making the payment process more interactive and transparent.

Pros and Cons

- Pros:

- User-friendly interface for non-accountants

- Excellent customer support

- All-in-one solution for invoicing, expenses, and reporting

- Great mobile app functionality

- Client portal and time tracking features

- Cons:

- Pricing is higher than some competitors, especially at scale

- No inventory tracking (may be a limitation for product-based businesses)

- Limited customization for reports

Pricing

FreshBooks offers several pricing tiers: Lite, Plus, Premium, and Select (custom pricing). While the Lite plan starts around $19/month, most small businesses will need the Plus or Premium tiers to unlock full features. Though not the cheapest, the value-for-money is solid considering the features and ease of use.

Final Verdict: Is FreshBooks Worth It in 2025?

If you’re a freelancer, service provider, or small business owner looking for a stress-free way to manage your finances, FreshBooks is one of the best tools available today. Its clean interface, powerful invoicing, and client-friendly features make it ideal for modern businesses that want efficiency without the learning curve. While larger companies or product-based businesses might need something more complex, for its target audience, FreshBooks is a top-tier choice in 2025.

Try FreshBooks with a free trial and see how it fits your workflow—you might just ditch your spreadsheet for good.