Introduction: What is Square and Why Are Small Businesses Relying on It?

In 2025, running a small business is about more than just sales—it’s about smart management, seamless payments, and a unified experience across online and offline channels. Square has emerged as one of the most trusted names for entrepreneurs who need more than just a point-of-sale (POS) system. From mobile payments to full-blown retail management, Square aims to be your all-in-one business toolkit. But is it the best solution for your business? Let’s explore.

What is Square?

Square is a comprehensive suite of business tools developed by Block, Inc. It started as a mobile payment processor but has since evolved into a full-service ecosystem that includes POS systems, eCommerce solutions, payroll, inventory management, marketing tools, and even banking services. Whether you’re a food truck, boutique retailer, service provider, or online seller, Square offers a customized solution to help you manage and grow your business.

Core Features of Square in 2025

Here’s a breakdown of what Square brings to the table:

- Point of Sale (POS): A sleek, easy-to-use POS system that supports mobile devices, tablets, and dedicated Square terminals. Accepts all major payment methods including contactless, chip cards, and digital wallets.

- Square Online: Build a full eCommerce store with integrated inventory, shipping, and payment tools. Perfect for businesses that operate both in-store and online.

- Payment Processing: Competitive transaction rates (typically 2.6% + 10¢ for card payments), with no monthly fees for basic use.

- Square Appointments: Ideal for salons, consultants, and service-based businesses. Clients can book, reschedule, and pay online.

- Square Invoices: Create and send professional invoices. Set up recurring billing, reminders, and automatic payments.

- Inventory Management: Real-time stock tracking across locations, with alerts and low-stock notifications.

- Square Banking: Business checking, savings, and Square Loans integrated directly into your dashboard.

- Payroll & Team Management: Process payroll, manage employee timecards, and handle taxes in one place (available in select regions).

User Interface and Experience

Square excels in user experience. Whether you’re using the POS hardware, mobile app, or web dashboard, the interface is clean, modern, and intuitive. New users can get set up in under an hour, and everything—from transactions to taxes—is clearly laid out. The mobile apps (iOS and Android) are particularly polished, making Square a solid option for businesses on the go.

Performance and Integration

Square is built to scale with your business. It performs reliably, processes payments quickly, and supports integration with popular platforms like QuickBooks, WooCommerce, Wix, Mailchimp, and Zapier. It also syncs seamlessly across Square’s own services, which reduces friction between in-person and online operations.

What Makes Square Unique?

Unlike competitors that specialize in just one area—such as POS, invoicing, or eCommerce—Square combines everything into a cohesive platform. This end-to-end approach saves time and reduces the need for third-party tools. Square also stands out for its hardware options, including the Square Terminal, Square Register, and mobile readers, which are stylish and affordable.

Another game-changing feature is Square Banking, which allows businesses to get paid instantly, access loans based on sales history, and manage funds without leaving the platform.

Pros and Cons

- Pros:

- All-in-one solution for payments, online sales, and operations

- Free basic POS and website builder

- Excellent user experience and ease of setup

- Reliable, fast payment processing with transparent fees

- Square Loans and Banking add financial flexibility

- Cons:

- Transaction fees may add up for high-volume businesses

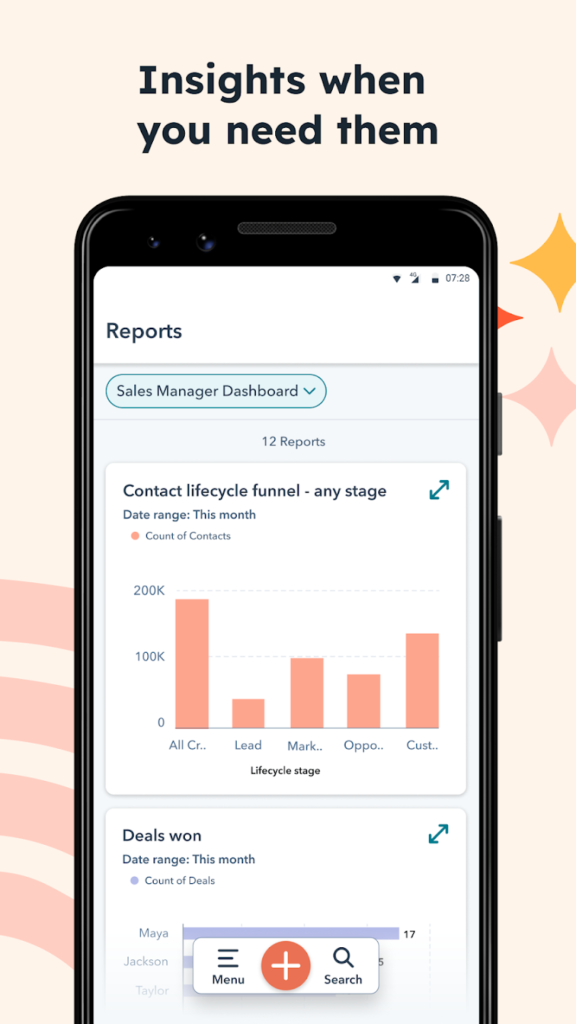

- Some features (e.g. advanced reports, marketing tools) require paid add-ons

- Limited international availability compared to global competitors like PayPal

Pricing Overview

Square keeps pricing straightforward:

- POS software: Free for basic features; Square Plus and Premium plans start at $29/month

- Online store: Free plan available; premium plans range from $12–$79/month

- Payment processing: 2.6% + 10¢ per swipe, dip, or tap; 3.5% + 15¢ for keyed-in payments

- Square Payroll: Starts at $35/month + $5 per employee

Optional add-ons like marketing tools and loyalty programs come at an additional cost, but everything integrates within the same dashboard.

Final Verdict: Is Square Worth It in 2025?

Square is one of the most versatile, feature-rich platforms for small and medium-sized businesses in 2025. Whether you’re starting a food truck, building an online store, or running a brick-and-mortar shop, Square offers the tools to sell, get paid, and manage your operations—all under one roof. It’s ideal for businesses that want simplicity, scalability, and no-fuss pricing.

Try Square today and see why millions of businesses trust it to power their sales and streamline their growth.

nezdpqekfjhzffyutloigitvvegnox

Likely